The domino effect of decisions in retail: from data to decision, from decision to profit

With new AI technologies, the potential for value created from data is significantly increasing. Solutions based on decision intelligence technologies provide this potential.

The "artificial intelligence transformation," which we've frequently heard about in the business world in recent years, is driving rapid advancements in many areas. However, the development that has most tangibly transformed organizations' competitiveness is the Decision Intelligence revolution. Decision Intelligence is a set of disciplines and technologies that combine data, analytics, advanced AI, and business rules to model, improve, and automate how decisions are made. As Gartner emphasizes in its Hype Cycle for Artificial Intelligence 2025 report, the goal is to enable people and businesses to make faster, more consistent, and more impactful decisions. Having defined this, I'd like to focus on a study that reveals the advantage that can be achieved through Decision Intelligence.

In a study conducted by McKinsey in 2025 to measure the added value that could be created by new artificial intelligence technologies and data analytics on a sectoral basis, it was determined that the total annual value potential of artificial intelligence and analytics was between 9.5 and 15.4 trillion dollars in total across all sectors.

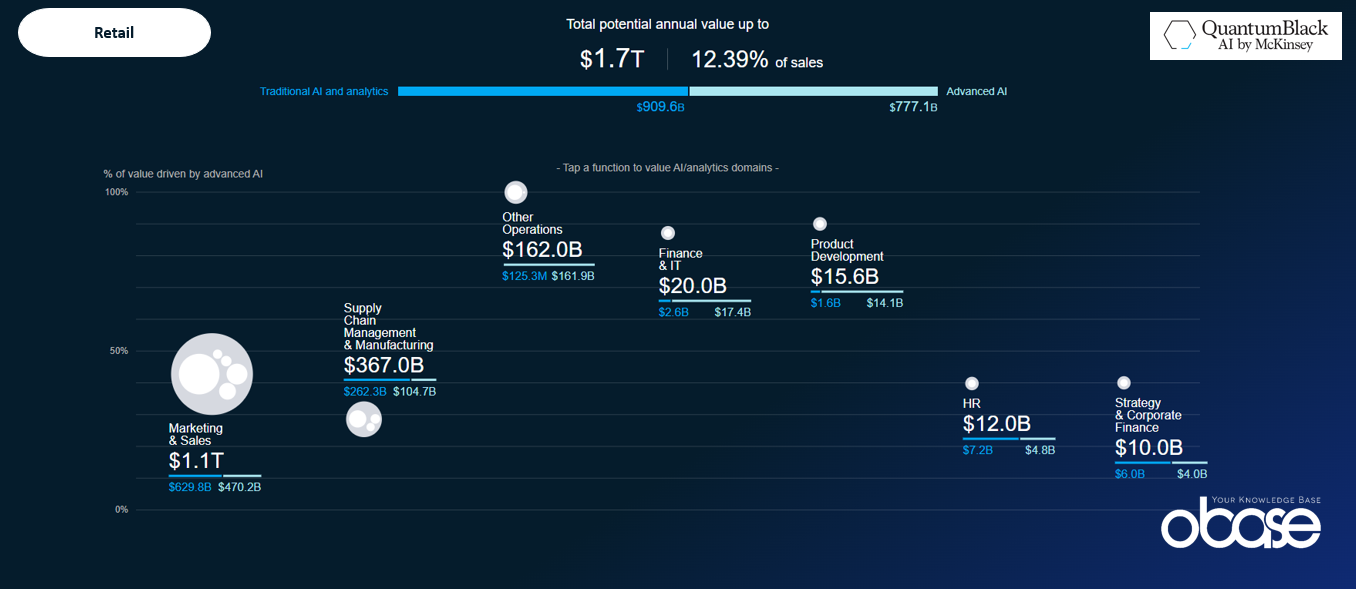

The same study also projected a combined value-added potential of over $3.1 trillion in the Retail and CPG (Consumer Ready-Made Goods) sectors. The study calculated the annual value-added in the retail sector alone at $1.7 trillion. This figure represents over 12 percent of total retail sector annual sales. Retail has the highest potential for creation of all sectors, followed closely by the CPG sector, which is closely intertwined with retail. According to the study, Retail+CPG accounts for 20 percent of the potential value created across all sectors.

Of the total potential annual value of $1.7 trillion in the retail sector, $909.6 billion comes from traditional AI and analytics, and $777.1 billion from advanced AI technologies.

Why is the added value created by advanced AI and data analytics in retail and CPG so high?

The dynamism and fast pace of retail, the thousands of decisions that must be made while monitoring real-time and near-real-time operations, and the need for optimization in every action within tight profit margins are the main reasons for this. The more decisions a business makes and the more they can be implemented without delay, the greater the value generated. Tens of thousands of decisions are made daily in a store chain, such as pricing, inventory distribution, and campaign management, across products, channels, stores, and even customers. With increasing digitalization and the continuation of the customer journey through new channels, the volume of customer-focused data is exponentially increasing. While traditional decision support systems and predictive analytics tools are proving inadequate, Agentic AI-powered decision intelligence solutions are increasing the value derived from data.

The domino effect of decisions

Retail has what experts call a "coupled decision system." Price influences demand, demand influences inventory levels, which influence stock replenishment decisions, and campaign pricing and segmentation decisions. This chain-based structure enables modern AI systems to create added value by correlating the outputs and effects of multiple processes and orchestrating the process to achieve the company's core objectives.

For example, imagine launching a 20% discount campaign on a dairy product.

This single decision creates a domino effect; if not addressed promptly, the consequences can be both positive and negative. Let's share a representative scenario.

- Price reduction → Increase in demand: Sales increase by 40%

- Increase in demand → Stock decrease: 5 stores quickly run out of products

- Stock drop → Urgent replenishment: Urgent shipment from the warehouse is planned

- Shipping → Logistics pressure: Distribution of other products is delayed

- Selling out → Customer loss & substitute sales: Customer turns to a competitor or a different product.

This knock-on effect demonstrates that decisions must be considered at a systemic level, not just at the individual unit level. This is where decision intelligence comes in: It evaluates each decision within the entire system and automates the scenario that delivers maximum benefit.

Very high impact in marketing and sales

Returning to McKinsey's research, we see that the greatest value-added potential in retail lies in sales and marketing. By analyzing customer behavior in real time, AI can provide personalized product recommendations for each customer, optimize campaign timing, and instantly adjust pricing strategies.

According to research analysis, this area alone could generate $1.1 trillion in potential annual value. Of this, $629.8 billion comes from traditional AI and analytics tools, while $470.2 billion comes from advanced AI technologies. Within this scope, advanced AI has a significant impact in areas like hyperpersonalization, dynamic pricing, and retail media .

In the retail sector, the supply chain ranks second after marketing and sales, with a value creation potential of $367 billion. In this context, improving order and inventory management decisions, triggered by the instant detection of demand-influencing factors and anomalies, is a significant area of potential gains enabled by advanced AI.

CPG's supply chain emphasis

Looking at the CPG sector, understanding demand from the retail and consumer channels they serve is their top priority, and this study suggests that decision intelligence solutions can contribute most significantly to the supply chain. In the supply chain and production sectors, which are the largest cost drivers in the CPG sector, AI maximizes profits through micro-optimizations in these processes. Value is created through forecasting, optimization, and then agentic automation.

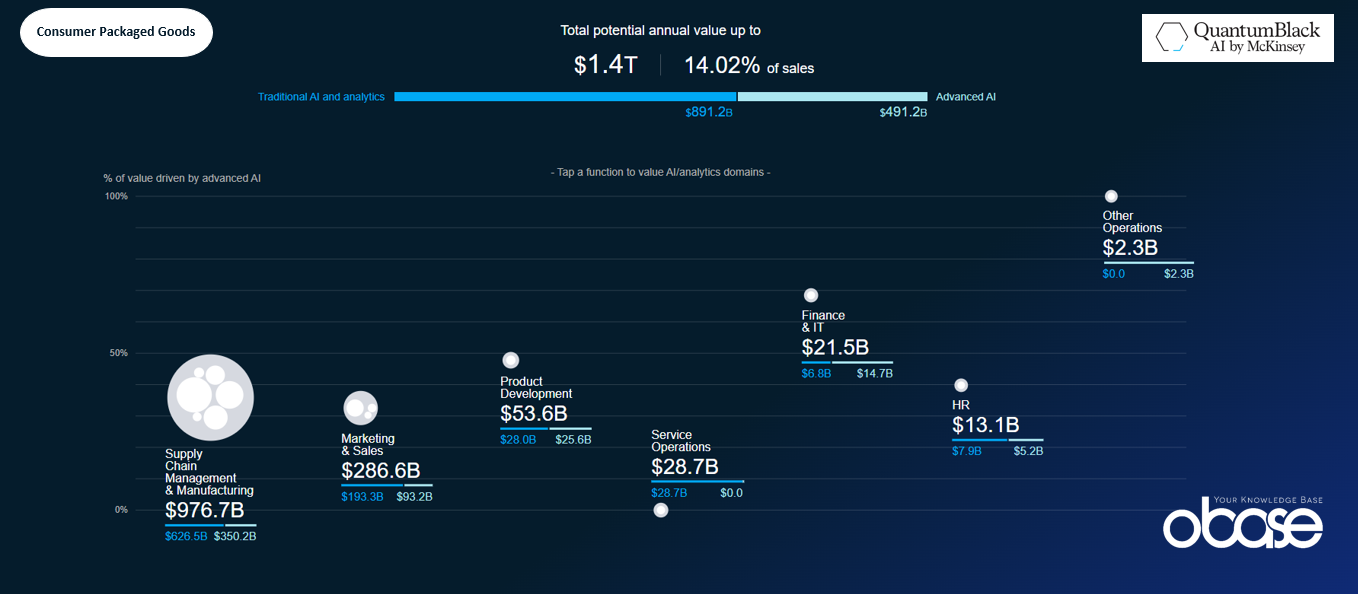

The total potential annual value of the CPG sector is $1.4 trillion, representing 14.02% of sales. Supply chain management is the largest value area at $976.7 billion, followed by marketing and sales at $286.6 billion.

In the CPG sector, supply chain management and manufacturing alone offer a potential of $976.7 billion ($626.5 billion for traditional AI and $350.2 billion for advanced AI). This represents approximately 70 percent of the industry's total AI value. Marketing and sales have a potential value creation of $286.6 billion, product development $53.6 billion, and service operations $28.7 billion. According to a Google Cloud report released in 2025, 38 percent of companies are implementing AI agents in supply chain and logistics, generating an ROI of up to 2 percent of annual revenue.

The paradox: high potential, moderate execution

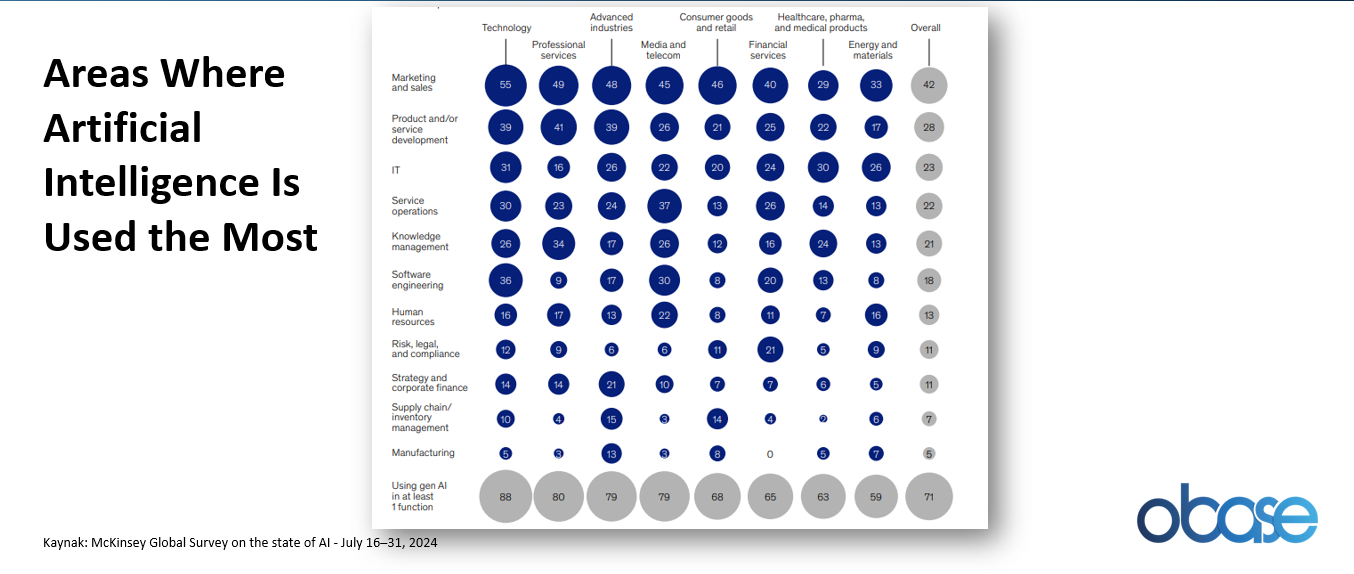

However, McKinsey's "Global Survey on the State of AI" research published in July 2024 reveals an interesting fact: Although the highest value creation potential appears to be in the retail and CPG sectors, when we look at the areas where artificial intelligence is used most, the sum of these two sectors ranks in the middle, at 5th place among other sectors.

According to the research, the percentage of companies using AI in marketing and sales is 55% in the technology sector, 49% in professional services, and 48% in advanced industrial sectors, while it remains at 46% in the retail and consumer goods sector. Similarly, when examining productive AI adoption rates, the retail sector is below average at 68%.

This could be interpreted as a sign that the retail sector is being more cautious in its technology investments, or that it hasn't yet fully achieved the necessary infrastructure and maturity. Issues such as data quality, integration between systems, and organizational change management, in particular, stand out as key obstacles facing the sector.

Conclusion

Thanks to the integration of industry-specific knowledge into new decision intelligence technologies, previously disconnected processes are now becoming more tightly connected, synchronized, and manageable through shared intelligence. This heralds a brand new era of value creation for retail.

However, for this potential to become a reality, simply having data is not enough; the competence to quickly and intelligently translate that data into action is required.

While many retailers are still searching for ways to increase efficiency, those who use their data effectively will gain a significant advantage over their competitors. Because in this game, it's not just the "right decision" that wins, but the right decision made at the right time .

Read the Retail Turkey article